Why Is Crypto Down Today? Will Crypto Recover Again? Best Crypto to Buy in the Dip

Why is crypto down Today? Bitcoin is inching closer to $90,000, while Solana is approaching $130. Will crypto recover? Best crypto to buy?

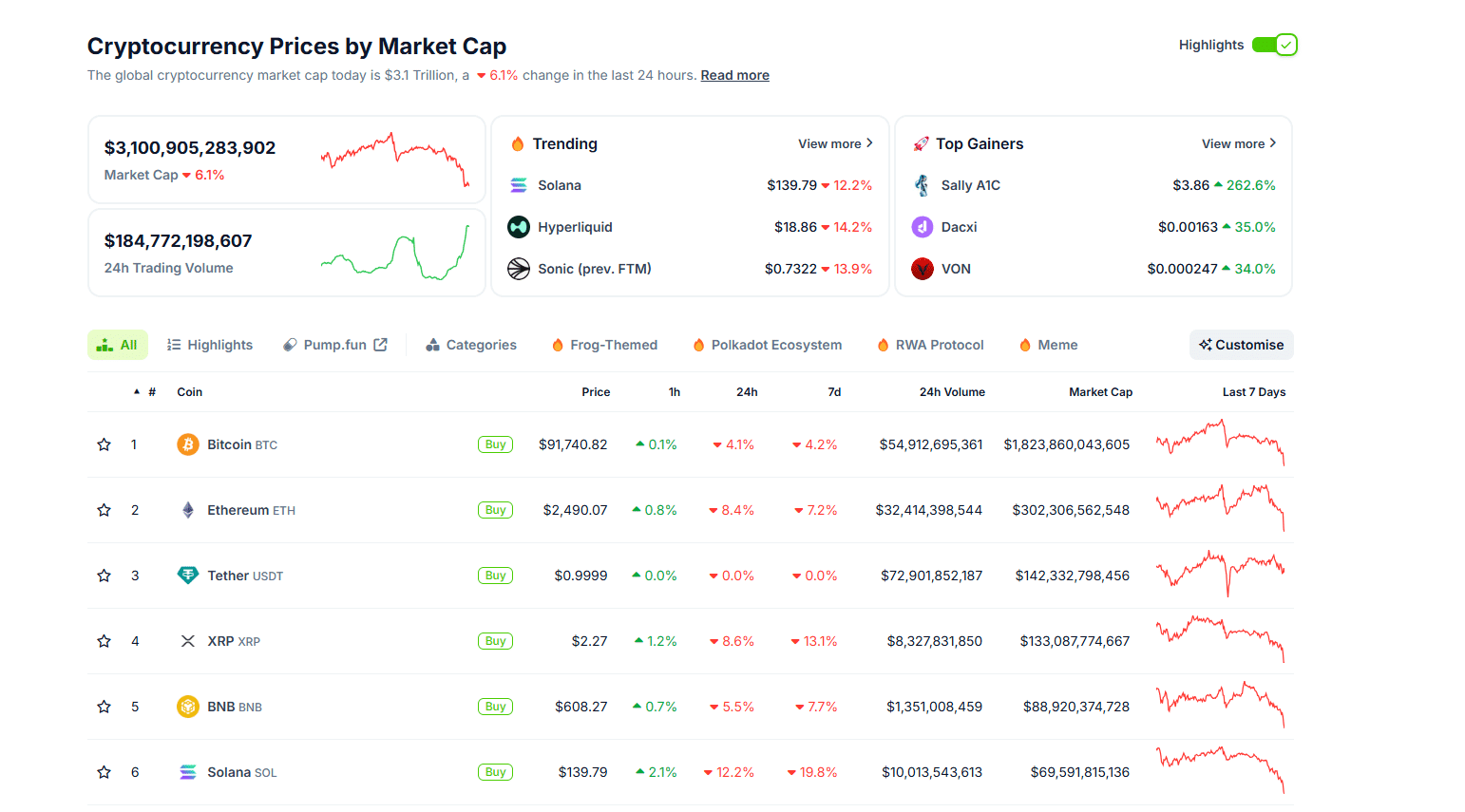

Bitcoin, Solana, Ethereum, and the broader crypto market are pulling back. On the last day of trading, the total market cap dropped over 6% to $3.1 trillion, according to Coingecko.

This downturn has hit top altcoins hard, with most shedding nearly double-digits in the past 24 hours. Bitcoin is trading below $93,000, while Ethereum is struggling to break $2,600.

Other major players like Solana, BNB, and Cardano have also posted sharp losses—Solana, for instance, is down 12% on the last day, pushing weekly losses to over 19%.

The sell-off has analysts and traders on edge, prompting caution and diversification. Many are now hunting for the best cryptos to buy as a hedge against further declines.

The sell-off has analysts and traders on edge, prompting caution and diversification. Many are now hunting for the best cryptos to buy as a hedge against further declines.

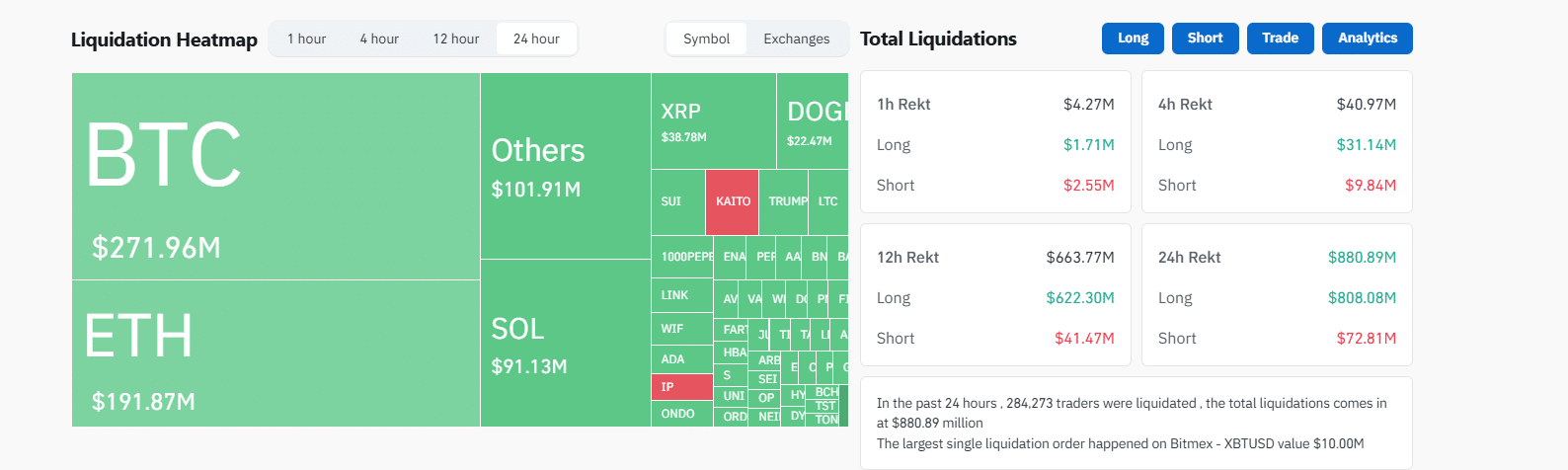

Over $880 million in long positions were liquidated on perpetual exchanges in the past 24 hours, with more than 283,000 traders losing their collateral as exchanges sold off assets to limit losses, per Coinglass data.

Why Is Crypto Down Today?

Several factors are driving the current market slide.

From a technical perspective, crypto prices are cooling after a strong Q4 2024, when Bitcoin, Solana, and BNB surged to new all-time highs. On Bitcoin’s daily chart, $90,000 is a critical support level.

If it fails, prices could slide to retest 2021 highs around $74,000. Given Bitcoin’s dominance, such a drop would likely drag the rest of the market down, amplifying losses.

Fundamentals are also tilting toward the USD in the short to medium term. Recent labor market and inflation reports signal a robust economy, reducing the odds of Federal Reserve rate cuts. With higher yields in sight, investors are shifting to bonds, drawn by the safety of elevated interest rates over riskier assets like crypto.

Retail Markets In Dispair: Will Crypto Recover?

Whether bulls can stem the bleeding remains uncertain – but retail are desperate to know ‘will crypto recover?’.

If they do, this dip could mirror a correction rather than the start of a bear market, akin to patterns seen in 2018 and 2022. Should inflation stabilize or decline—and if economic conditions shift—the Fed might adopt a dovish stance and resume rate cuts. A looser monetary policy could reignite demand, lifting crypto prices.

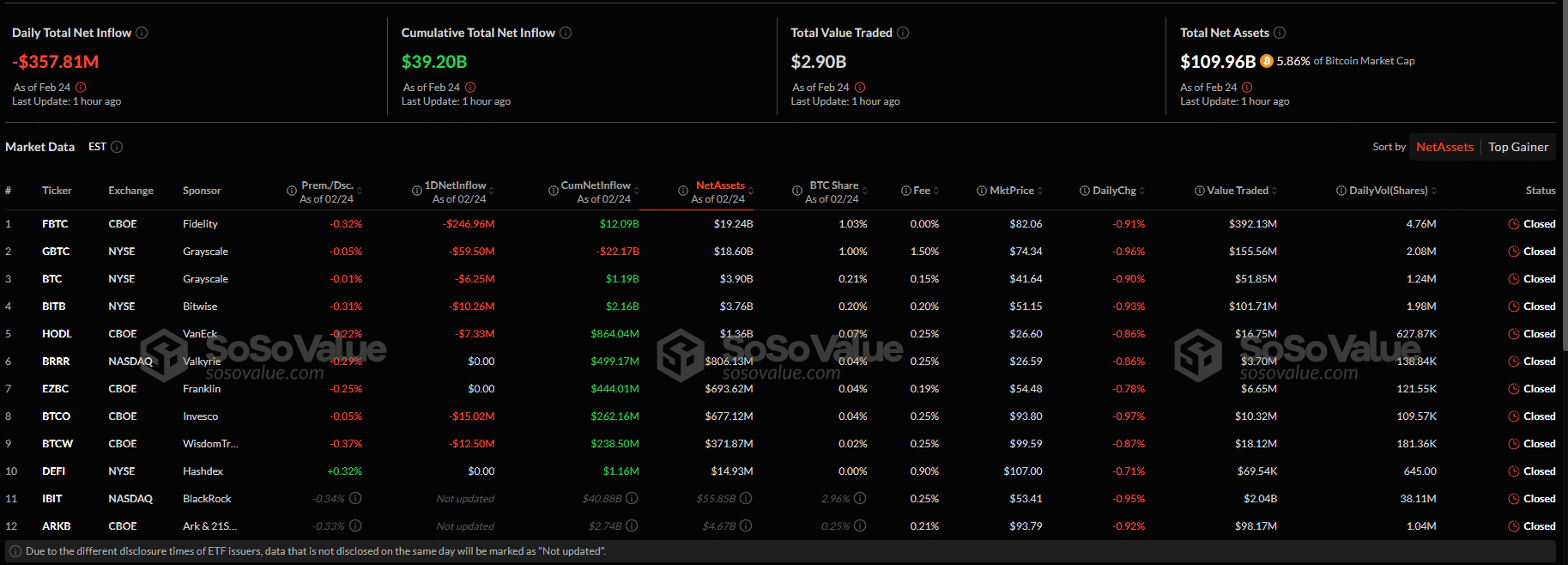

Meanwhile, institutional flows via spot Bitcoin ETFs are under scrutiny. More firms are cashing out, with outflows reflecting the trend. Per SoSo Value, over $357 million in spot Bitcoin ETF shares were redeemed on February 24 alone.

Best Crypto to Buy in the Dip: Is BTC Bull a Smart Pick?

Amid this correction, some analysts remain optimistic, and investors are eyeing opportunities with strong upside potential.

Among the options, BTC Bull stands out due to its unique value proposition. This ERC-20 token on Ethereum blends the allure of meme coins with Bitcoin’s potential.

BTC Bull rewards holders with BTC based on Bitcoin price milestones: when Bitcoin hits $150,000, holders receive free BTC, with additional airdrops at $200,000 and $250,000.

The project also features an automatic token-burning mechanism tied to Bitcoin’s price.

For example, if BTC crosses $125,000, BTC Bull will burn a portion of its supply, reducing circulation and potentially boosting value.

So far, BTC Bull has raised $2.7 million in its presale, with tokens available for $0.00238 at the current stage. Prices will increase in the next 30 hours, act now. You can buy BTCBULL using ETH, USDT, USDC, or cash.

Conclusion: Navigating the Crypto Market Downturn

The crypto market is experiencing a sharp pullback, with Bitcoin, Ethereum, and major altcoins facing significant declines. The downturn is driven by a mix of technical corrections, macroeconomic factors, and shifting investor sentiment. Rising bond yields and reduced expectations of Federal Reserve rate cuts are prompting a shift away from risk assets like cryptocurrencies.

Despite the current uncertainty, historical trends suggest this could be a temporary correction rather than the beginning of a prolonged bear market. If inflation eases and monetary policies turn more accommodative, crypto prices may recover. Institutional flows, especially through Bitcoin ETFs, will be crucial indicators of future trends.

For investors looking to buy the dip, assets with strong fundamentals and unique value propositions, such as BTC Bull, present potential opportunities. However, caution is advised, as market conditions remain volatile.